A long/short investment strategy is usually associated with hedge funds, but a growing number of cryptocurrency owners are using the same approach to diversify their portfolio and increase their profits.

If you like the idea of making money when cryptocurrency prices go up and down, then this is a strategy you want to pay attention to.

In this guide, we’ll be showing you how to long/short cryptocurrencies and what this can bring to your investment strategy.

By the time you’ve finished reading this, you’ll know the following:

-

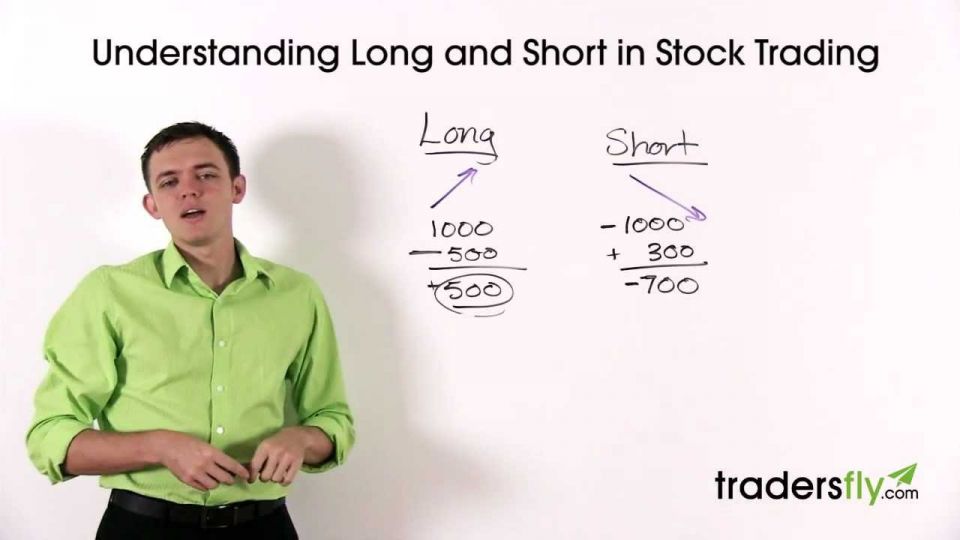

The best long/short strategies combine both methods to create a more diverse and profitable investment portfolio.

By going long, you’re investing in the long-term profitability of your cryptocurrencies, but you can also profit from price drops with some smart short selling.

The key thing to remember with your overall long/short strategy is that prices always come down faster than they go up, but they also go up the majority of the time.

As David Gardner puts it:

“Stocks always go down faster than they go up, but they always go up more than they go down.”

In fact, the guys over at The first thing you need to do is make sure you use a cryptocurrency exchange platform that allows you to go long and short on your investments.

As we said before, many exchanges don’t allow you to buy cryptocurrencies outright, which means you can’t manage a long/short strategy – at least not from a single platform.

We’ve mentioned eToro a few times in this article, and we recommend this as the place to start if you want to implement a long/short strategy with your crypto investment.

The main reason is that eToro allows you to trade Bitcoin, Ethereum and Litecoin directly so you don’t have to buy into cryptocurrency – something many exchanges don’t approve.

Crucially, you can also use short selling tactics like CFDs on eToro, which means you can manage your entire long/short strategy from a single platform. This is important when you have to react quickly, as tends to be the case with short selling.

The main downside with eToro is that fees are higher than many exchange platforms, but you get a lot of flexibility in return.

By all means, look at other options and decide which exchange platform suits your needs but eToro gets our vote for managing long/short cryptocurrency strategies.

eToro also offers a free demo account if you feel like you’re ready to give it a go! You can sign up to eToro here.

Got any questions about long/short cryptocurrency investment? Or, perhaps you’ve already got experience that other investors could learn from. Let us know your thoughts on this strategy in the comments below!

The post How to Long/Short Cryptocurrencies first appeared on BiteMyCoin.com.

Go to Source

Author: Megan Frydel