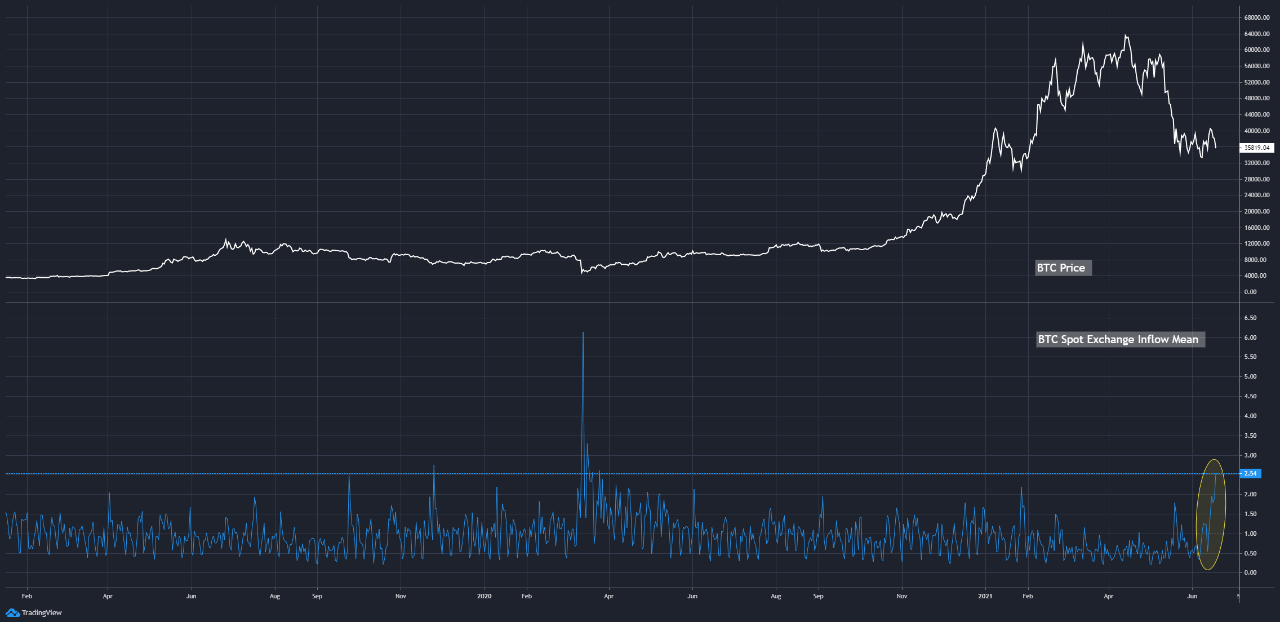

Bitcoin has fallen to almost over 50% of its USD price in two months and chances are of more adverse situations. Reports which show dumping of Bitcoin also reveal people who deposited huge portions of their assets now seem to exchange.

March 2020, month of highest dump

In a matter of time, in digital currency market a lot of things can change. As in April Bitcoin surged to go highest on $65000. Many investors seem to be very hopeful of Bitcoin and thought of a six digit

Value of this particular cryptocurrency. But few of them also predicted Bitcoin’s demise.

Demise of Bitcoin

As predicted by few of investors, Bitcoin dumped to $30000 because of FUD from China Ang negative news from Elon and Tesla.

Though Bitcoin raised to $10000 in next weeks following developments in EI Salvador, but it was not worth it due to China’s massive crackdown.

Uncertainty about Bitcoin

Thus Bitcoin dropped to it’s lowest Ina few days. Uncertainty raised and investors seemed taking actions on it. Crypto Quant’s research says that June 21st was highest spike in inflow from external wallets since March 2020 crash. An important point is that above mentioned crash resulted in 50% drop in Bitcoin’s price.

Worse situation

Shareholders withdrawing their assets is right now just a tip of iceberg as facts and figures show that Bitcoin crossed 50 day MA to 200 day MA which leads to massive crash. Earlier this resulted in severe price movements.

On a different note, other platforms say that the investors have not just refrained from funding Bitcoin but they have started withdrawing. Also, Bitcoin investors have started desposing their assets which can result in severe price dump.

The post Highest inflows of Bitcoin to Spot Exchanges in a Year is not a Good Sign for Market appeared first on Ripple Coin News.

Go to Source

Author: Gracie Perez