Price dislocations between futures and spot markets led altcoins like ETH, LTC and SUSHI to trade up to 43% below their index price in spot markets.

Traders have become accustomed to perpetual futures markets trading pretty much in line with the regular spot markets. After all, there are incentives for arbitrage desks to buy those contracts at a discount.

However, during periods of extreme volatility, market makers typically are not able to meet the demand. This movement could happen due to connectivity problems with the exchanges serves or the market makers’ lack of funds to add more positions.

While these situations are rare, today’s performance was nothing short of unusual as some altcoins dropped by 30% or more. This movement caused anomalies on futures contracts, which created a buying opportunity for those savvy enough to take advantage.

Take notice of how Ether/USDT perpetual contracts at Binance reached a $1,400 intraday low while the regular spot market bottomed at $1,888. This $488 difference, or 26%, was likely caused by aggressive liquidation orders, which totaled $2 billion at Binance.

The perpetual futures price gap did not trigger liquidations

It is worth noting that users were not harmed by the price difference as liquidations are triggered by the index price, which is an average from multiple spot exchanges. Thus, even if the perpetual futures trade below the reference, the automatic stop orders are not triggered.

As one move to less liquid altcoins, the situation tends to get worse. This is caused mainly due to light orderbooks, fewer market participants, and less interest from market makers due to lower volumes.

Sushi perpetual futures at Binance hit a $5.80 low, while regular spot markets bottomed at $10.25, a 43% difference. Notice that such extreme gaps seldom last for more than 15 minutes, as new market participants enter the scene to buy at a discount.

The above chart shows Litecoin’s September futures at OKEx, which traded over $250 million over the past 24 hours. Despite the liquidity, it traded at $128.20 low, while spot exchanges had a $152.50 bottom. The 16% price difference shows how both perpetual futures and monthly contracts price might face momentarily price distortions.

One easy way to avoid futures’ distortions

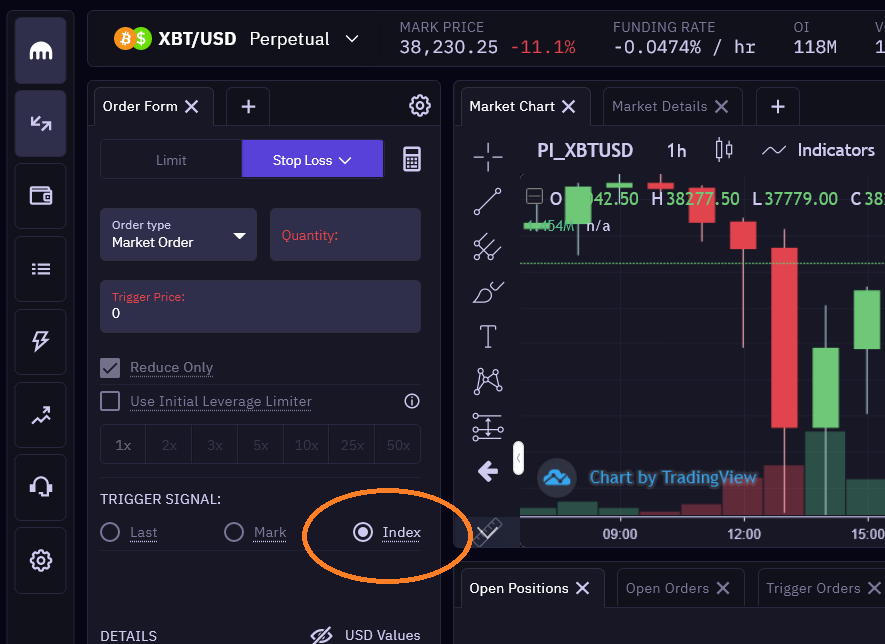

While the price gap won’t trigger liquidation orders, it does affect traders that entered stop orders based on ‘last’ or ‘mark’ price. Most derivatives exchanges will allow users to choose which pricing source should be used.

As shown above, it’s crucial that futures traders hoping to avoid price distortions like the one seen today select the ‘index’ price, as this is calculated by the average price on spot exchanges instead of the perpetual contract itself.

For traders who might have been liquidated on today’s move, it’s better to avoid entering new positions at the moment. A better move would be to study the market and better understand how volatility impacts leverage trading, a topic which was thoroughly discussed by Cointelegraph recently.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Go to Source

Author: Marcel Pechman