Binance Coin (BNB) is currently in a bearish trend and risks dropping below its major support level at $506 if the market continues in this fashion.

The cryptocurrency market shed off billions of dollars over the course of the last few days, with several cryptocurrencies still struggling to regain their losses. Bitcoin and Ethereum added less than 1% to their value over the past few hours. However, BNB, the third-largest cryptocurrency by market cap, is still trading in the red.

Despite its recent slip, BNB has performed excellently over the past year, and several analysts and experts believe it will recover and climb higher again soon.

🤔 Will be really interesting to watch the performance of $ETH / $MATIC and $BNB over the next 5 years.

Here is how they performed over the past year btw:$ETH – 1,551%$MATIC – 9,567%$BNB – 3,124%

— Dave Craige ⚡️ (@davecraige) May 18, 2021

BNB price outlook

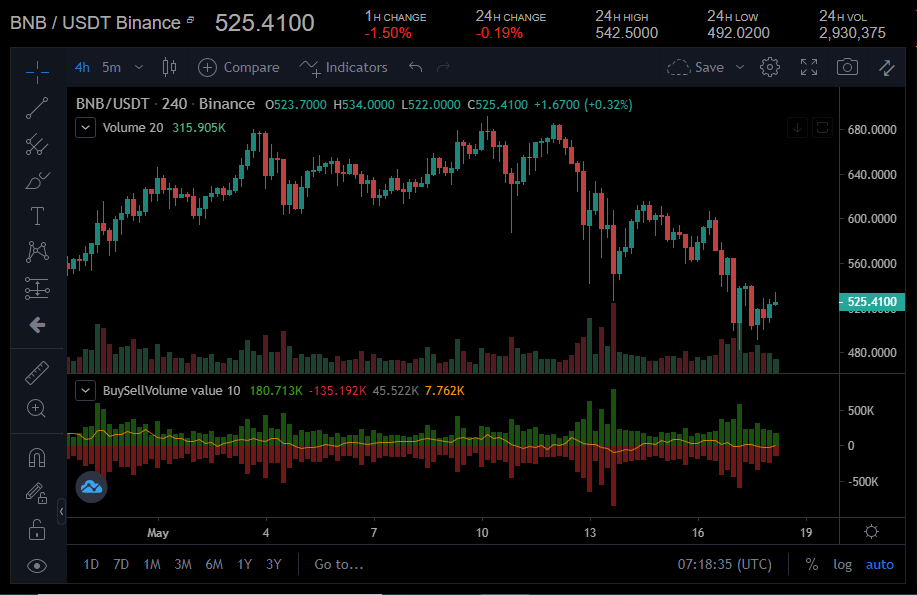

Although BNB has performed excellently over the past year, it has underperformed in the short term. Over the past seven days, BNB is down by 16% as it struggles to stay above the $520 level. The bears are in control of the market, and it is clear from the BNB/USDT 4-hour chart.

BNB/USDT 4-hour chart. Source: Coinalyze

Its 100-day simple moving average of $619 is higher than BNB’s current trading price. Other technical indicators, including the RSI (40.83) and the MACD line, are also in bearish mode. If the current trend continues, BNB could drop below its major support level of $506. An extended bearish run in the market could see the BNB slip below $500. However, BNB has established strong support at $499, which could prove hard for the bears to break.

Binance Coin could need the support of the general market to break out of this bearish trend. If the bulls take control, the BNB /USDT pair could rally past the first significant resistance at $523. This would provide the platform for BNB to attempt the next resistant level at $569. Doing so would reverse the losses accumulated over the past few days.

The post Binance Coin Price Analysis: BNB Risks Losing $506 Support appeared first on The Home of Altcoins: All About Crypto, Bitcoin & Altcoins | Coinlist.me.

Go to Source

Author: Hassan Maishera