One of the most exciting advancements to the crypto landscape are the various ways of using your cryptocurrency in everyday life. Crypto debit cards (also known as Bitcoin debit cards) allow crypto enthusiasts to spend their holdings as easily as any other card in their wallet or phone.

What are crypto debit cards?

Crypto debit cards are used for making purchases either online or in person, much like a traditional debit or credit card. Instead of drawing funds from a checking account, crypto debit cards are pre-loaded with cryptocurrency from the user’s preferred crypto wallet. With each purchase, the appropriate amount is deducted from the card balance.

Crypto debit cards should not be confused with crypto credit cards, which are similar to regular credit cards but often give cardholders the opportunity to earn cryptocurrency rewards. Both options offer users a highly flexible way to use or earn crypto, but their differences mirror those between traditional debit and credit cards.

How to get a crypto debit card

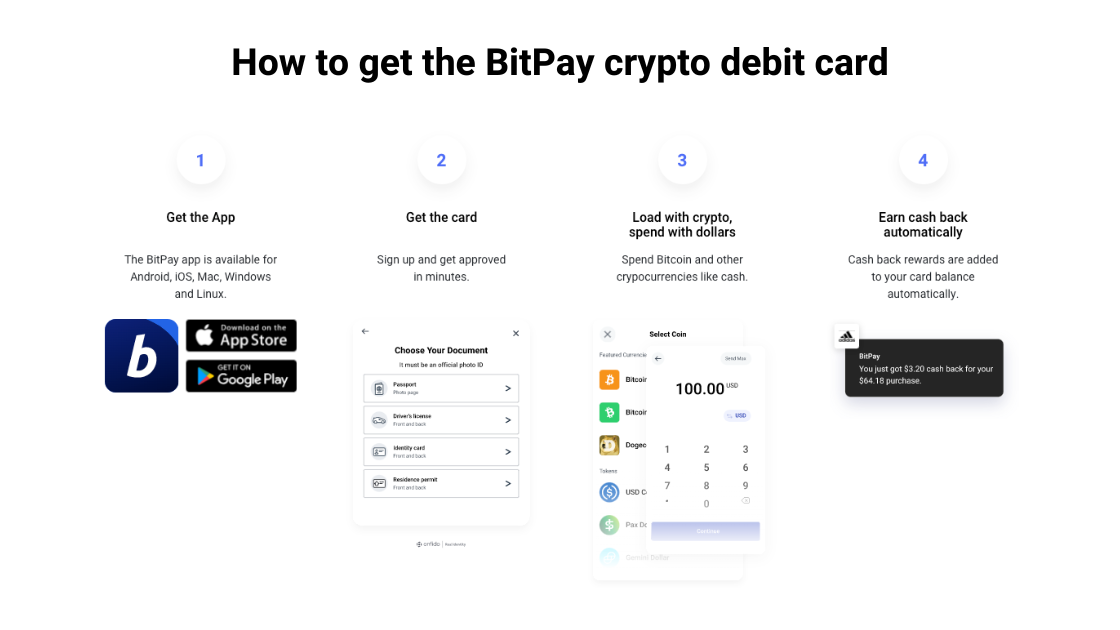

The process of getting a crypto debit card of your own will vary depending on the provider you choose. BitPay has made the sign-up and approval process for the BitPay prepaid debit card fast, easy and secure. Simply sign up, get instant approval and start spending within minutes. Unlike with a crypto credit card, there is no credit check required to get a crypto debit card, and using the card won’t impact your credit. Several providers offer a virtual card only, while others, like BitPay, also offer a physical card option as well. Once approved, you are able to start spending using your virtual debit card immediately.

How to use crypto debit cards

The first thing you’ll need is a crypto wallet, this will be used to load up your crypto debit card with funds you intend to spend. Compatible wallets will likely vary by provider. The BitPay Card, for example, can be loaded from your BitPay Wallet or Coinbase account.

Crypto debit cards are available in both virtual and physical form, and both versions can be used either online or in-store. Once you’ve connect your wallet and the card is loaded with cash, there are a number of ways to use your crypto debit card:

- Use the virtual card for online purchases

- Connect the virtual card to your Apple Pay or Google Pay wallet on your phone for carry crypto spending power in your pocket anywhere you go

- Carry the physical card in your wallet to tap or swipe at checkout

- Insert your physical card and pull cash straight from any compatible ATM around the world

The best crypto debit cards will also have an intuitive app where you can track purchases and manage card preferences, in addition to topping off the card.

Crypto debit card rewards

Some crypto debit cards offer rewards programs to encourage continued use. The BitPay Card offers instant cash back when you use it at thousands of locations, automatically adding it to your balance with every purchase and with no restrictions on how it can be spent. Others require users to stake crypto funds in order to earn cash back in the form of a native token, typically in the 1-8% range depending on the tier of card. Many cards, including the BitPay Card, also offer referral bonuses where users are rewarded when friends sign up and load their card.

How to choose the best crypto debit card

Choosing the best crypto debit card for you depends on your priorities and spending habits. What is the best crypto debit card? That will depend on what aspects are most important to you. To find the very best card for you, consider the following:

How much will you spend?

Some cards impose limitations on the amount of funds you can load onto them each day, typically in the $10,000-$30,000 range for most base tier cards. Different providers offer variations of their crypto debit cards with fewer loading restrictions, but may require users to lock up a specified amount of crypto to qualify. Daily spending and ATM withdrawal limits also vary by card, with most falling within the $1,000-$10,000 range. The BitPay Card offers a daily load limit of $10,000 and a total balance limit of $25,000.

Do you primarily want to spend a single cryptocurrency or multiple cryptocurrencies?

If most of your crypto spending is done in Bitcoin or another single cryptocurrency, multi-coin support might not matter to you. However if you intend to convert multiple cryptocurrencies to cash with a debit card then you’ll want a card that supports as many as possible. The BitPay Card supports Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Dogecoin (DOGE), Shiba Inu Coin (SHIB), Litecoin (LTC), Dai (DAI), Wrapped bitcoin (WBTC), Gemini USD (GUSD), USD Coin (USDC) and Binance USD (BUSD). We are constantly evaluating and adding support for new coins.

How do you want to load the card?

In order to load your crypto debit card with funds, you’ll first need a crypto wallet or an exchange account. From there, you can transfer the desired amount of funds to top off the balance on your crypto debit card. The BitPay app greatly simplifies the process, allowing users to convert crypto to cash, spend, reload and cash in crypto rewards all from one place.

Where do you plan to use the card?

A crypto debit card is only useful if it’s accepted where you spend most. You’ll find that most crypto debit cards carry either the Visa or Mastercard insignia, which means they can be used at millions of global merchants and service providers. The BitPay Card can be used around the world at any merchant or ATM where Mastercard is accepted.

What types of fees are you OK with?

These will vary by provider, but some of the most common ones include activation or issuance fees, monthly usage fees, ATM fees and foreign transaction fees. Some of these fees are waived if certain monthly spending thresholds or other conditions are met, so be sure to read the fine print before choosing your card.

Do you want to earn rewards for using the card?

Many crypto debit cards offer rewards programs that let users earn cash or crypto on everyday purchases. Depending on the provider, crypto debit card users can receive as much as 8% cashback, but it’s important to look at any extra fees or requirements it may be necessary to meet before qualifying. BitPay users can earn cash back with every purchase at thousands of merchants. The rewards are automatically added to their pre-loaded card balance, with no hoops to jump through.

The best crypto card for spenders

FAQs about crypto debit cards

What fees can I expect to pay with a crypto debit card?

There are a wide range of fees card issuers impose on users, including activation/issuance fees, monthly usage fees, ATM withdrawal fees and foreign transaction fees. Some of these fees can be forgiven or waived if certain requirements are met. However, this all depends on the provider.

Will using a crypto debit card impact my credit?

Some crypto debit card providers may require a Social Security number for know-your-customer (KYC) compliance, but few if any will actually pull your credit report before issuing a card. The BitPay Card is a pre-paid crypto debit card that is loaded directly from a user’s crypto wallet, so no credit check is needed and signing up for one will not impact your credit score. To sign up for the BitPay Card you will need to verify your identity and status as a U.S. resident.

Are there load or spending limits for crypto debit cards?

Limitations on daily spending or how much crypto can be loaded onto a card will vary from card to card. The BitPay card, for example, has a daily load limit of $10,000 and a monthly spending limit of $25,000. Most cards will fall within this range, but certain cards offer different tiers where these limits can be significantly higher or lower.

Can the BitPay Card be used outside of the U.S.?

Yes. Although the card is only available to U.S. residents, once you’re approved you can use the BitPay Card worldwide, including foreign ATM withdrawals, provided the ATM itself is compatible.

What cryptocurrencies can I load onto a debit card?

This will vary by provider, but the BitPay card lets users instantly convert a carefully curated list of over a dozen popular cryptocurrencies, tokens and stablecoins including Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Dogecoin (DOGE), Shiba Inu (SHIB), Litecoin (LTC), Dai (DAI), Wrapped Bitcoin (WBTC), Gemini USD (GUSD), USD Coin (USDC) and Binance USD (BUSD).

Are crypto debit cards free?

Some crypto debit cards carry a small activation fee or a fee to receive a physical card. However, many, like the BitPay Card, provide a free virtual card that you can start using instantly after being approved.

Are crypto debit cards accepted everywhere?

Most crypto debit cards either carry a Visa or Mastercard insignia. In these cases, the cards can be used anywhere that Visa and Mastercard are accepted.

Go to Source

Author: The BitPay Team