Bitcoin is witnessing aggressive selling but if key support levels hold, ETH, ADA, SOL, and MATIC may lead the market higher.

During strong uptrends, every correction is aggressively purchased as the sentiment is positive and traders expect higher levels in the future. Therefore, corrections during a bull phase are shallow and the trend reasserts itself quickly.

However, when the trend changes from up to down, traders wait to sell on rallies because they believe lower levels are likely. In a bearish market, support levels are easily violated and the asset continues to slide.

Generally, a downtrend that is followed after a roaring bull market does not end before a capitulation phase where most bulls have given up on the hope for a sharp recovery. After that happens, the asset class bottoms out.

In the midst of all the volatility, traders should keep an eye on the fundamentals and the long-term story of cryptocurrencies. Instead of panicking, they should take an informed decision.

Let’s look at the top-5 cryptocurrencies that may attempt a relief rally in the next few days.

BTC/USDT

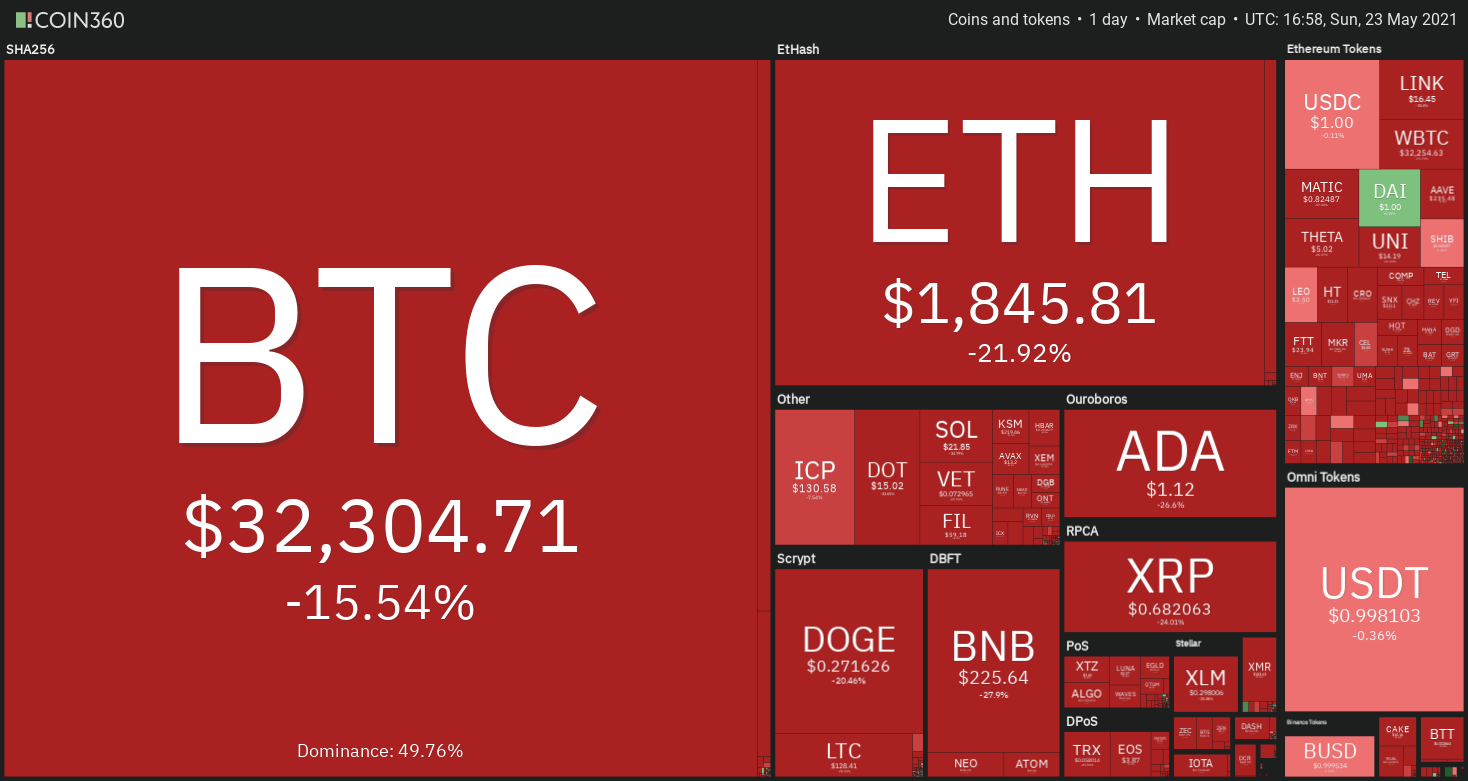

Bitcoin (BTC) dipped and closed below the 200-day simple moving average ($40,235) on May 19. Institutional investors watch this indicator closely and usually avoid buying if the price sustains below it for an extended duration.

Buyers pushed the price back above the 200-day SMA on May 20 but they could not sustain the price above it. This shows that bears are selling on rallies. The BTC/USDT pair could now drop to $28,850. This is an important support to watch out for because if it cracks, the selling could intensify further with the next stop at $20,000.

The downsloping 50-day SMA ($53,500) and the relative strength index (RSI) in the oversold zone suggest advantage to the bears.

However, if the price rebounds off the $28,850 support, the bulls will make one more attempt to push the price above the 200-day SMA. If they succeed, the pair could rise to the neckline of the head and shoulders pattern.

The 4-hour chart shows the relief rallies to the downtrend line are being sold by the bears. This suggests the sentiment has turned negative and traders are viewing the pullbacks to overhead resistance levels as a shorting opportunity.

The 50-SMA is sloping down and the RSI has been trading in the negative zone, indicating advantage to the bears. The first sign of strength will be a breakout and close above the downtrend line. Such a move could open the doors for a rally to $42,401 and then $46,000.

ETH/USDT

Ether (ETH) broke below the 50-day SMA ($2,776) on May 19. The bulls tried to push and sustain the price above the 50-day SMA on May 20 and 21 but failed. This shows that traders sold on rallies.

If the price sustains below $1,801.60, the ETH/USDT pair could drop to the 200-day SMA ($1,578). This level is likely to act as strong support. If the price rebounds off it, the pair could rise to the 50-day SMA where the bears are again likely to mount stiff resistance.

If the price turns down from the 50-day SMA, the pair may remain range-bound for a few days. Contrary to this assumption, if the bears sink the price below the 200-day SMA, panic may set in and the pair could drop to $1,289.09.

The 50-day SMA is flattening out and the RSI is approaching oversold levels, indicating the short-term trend is negative but the medium-term trend is neutral.

The pair is trading inside a descending channel on the 4-hour chart and the moving averages have completed a bearish crossover, suggesting the short-term trend is negative. If the bears sink and sustain the price below the support line of the channel, the selling pressure could increase and the pair may drop to $1,289.09.

On the contrary, if the price rebounds off the support line of the channel, the bulls will make one more attempt to push the pair above the channel. If they succeed, it will suggest the downtrend could be over and the pair may rally to $3,000.

ADA/USDT

Cardano (ADA) rebounded off the $0.95 level on May 19 and the bulls extended the relief rally on May 20 but higher levels attracted profit-booking and the price dipped back below the $1.48 support on May 22.

The $1 to $0.95 level is likely to act as strong support on the downside. If the price rebounds off this support, the ADA/USDT pair could again try to move up to $1.48. The flattening 50-day SMA ($1.44) suggests a possible range-bound action.

Contrary to this assumption, if the bears sink and sustain the price below the support zone, the pair could drop to the 200-day SMA ($0.77). A strong rebound off this level will suggest the markets have rejected the lower levels. The bulls will then once again try to push the price above $1.

If that happens, the pair may enter a consolidation. This view will invalidate if the pair breaks below the 200-day SMA.

The 50-SMA on the 4-hour chart has started to turn down and the RSI is in the negative zone, indicating advantage to the bears. However, the bulls are likely to step in and buy the dips near the critical $1 support.

If that happens, the pullback could reach the downtrend line, which is likely to act as stiff resistance. If the bulls drive the price above the downtrend line, the pair could rise to $1.48. This positive view will nullify if the pair breaks below the $1 to $0.95 support.

SOL/USDT

Solana (SOL) broke below the 50-day SMA ($37) on May 19 but rebounded sharply on May 20. However, the long wick on the May 20 candlestick suggests traders booked profits at higher levels and bears initiated short positions.

The selling picked up momentum on May 22 and the SOL/USDT pair broke below the 50-day SMA. The selling has continued today as the price dropped to the strong support at $21.10.

If the price rebounds off this support, the pair could attempt to rise to the 38.2% Fibonacci retracement level at $35.48. A breakout and close above the 50-day SMA will suggest the short-term trend could be tilting in favor of the bulls.

Alternatively, if the price turns down from $35.48, the bears will again try to sink the price below $21.10. If they are successful, the pair could drop to the 200-day SMA ($14.29).

The 4-hour chart shows the moving averages are on the verge of a bearish crossover, indicating advantage to the bears. However, the RSI has slipped deep into the negative territory, suggesting the selling may be overextended in the short term.

If the price rebounds off $21.10, the bulls will try to push the price above the downtrend line. If they manage to do that, the pair could attempt to rally to $35.48 and then to the 50-SMA.

Conversely, if the price turns down from the downtrend line, it will increase the possibility of a break below $21.10.

MATIC/USDT

Polygon (MATIC) has witnessed a sharp decline since hitting the all-time high at $2.70 on May 18. The altcoin has given up all the gains that it had accrued since May 11 and dropped to the 50-day SMA ($0.78).

The bulls are likely to defend the 50-day SMA and if the price rebounds off the support, the MATIC/USDT pair could rally to the 38.2% Fibonacci retracement level at $1.53. A breakout of this resistance will be the first indication that the selling pressure may be reducing.

On the other hand, if the price turns down from $1.53, the pair could drop to the 50-day SMA. The flattish 50-day SMA and the RSI below 45 point to a possible consolidation in the short term.

This view will invalidate if the bears pull the price below the 50-day SMA. If that happens, the pair could drop to $0.68 and then to $0.54.

The 4-hour chart shows the bulls are attempting to stall the waterfall decline at $0.80. However, any rebound is likely to face stiff resistance at the downtrend line. If the price turns down from this resistance, the downtrend may extend to $0.68.

The 50-SMA has started to turn down and the RSI is in the oversold territory, indicating advantage to the bears. This negative view will be negated if the price rebounds off the current levels and sustains above the downtrend line. Such a move could result in a relief rally to $1.53.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Go to Source

Author: Rakesh Upadhyay